Fast Track Modifications Are Back

Déjà vous? Fast track modifications are back with multiple banks and service providers. Before the melt down in 2008, loan modifications were provided over the phone with little or no documentation. The homeowner would call the bank, answer a few questions and would be provided a modification over the phone. The theory behind this ease…

Read MoreDetroit vs Everybody

Detroit filed bankruptcy, what does this mean? Detroit has chosen to file a Chapter 9 bankruptcy in order to eliminate, reduce and/or renegotiate its debt with creditors. Although many still hear bankruptcy and become frightened, it is better for Detroit to consolidate the lawsuits, creditors and attorneys all in one room, courthouse, then multiple courthouses,…

Read MoreHitting My Head Against The Wall

(The following post is from an anonymous high school student) Student loans . . . Really, what is it? For students still in high school they depend on their parents to pass on their college experience to help them, which is bad for kids whose parents didn’t go to college or just community college. From…

Read MoreChapter 7 Vs Chapter 13

A lot of people are familiar with a Chapter 7 and usually go to an attorney requesting their Chapter of preference. Many people prefer a Chapter 7 because it is quick and relatively simple. All of the unsecured debt is discharged in approximately 90 days. You can also surrender your interest in secured property like…

Read MoreThe LOAN Ranger

Back in July I blogged about the idea that the State of California considered….Eminent Domain. The idea of Eminent Domain is that the government can take land that is not being used to its potential and reuse it for the good of the state. California argued that if they could take the massive load of…

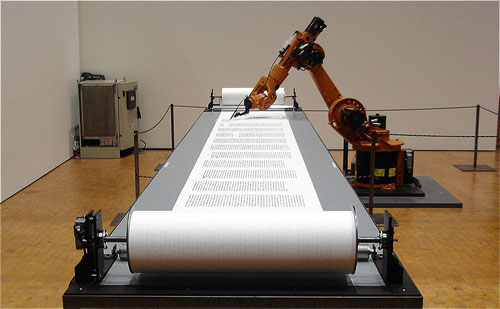

Read MoreNotes, Assignments and Certification

A lot of people may be familiar with” Robo signing”( someone without authority rubber stamping assignments) which created a moratorium on foreclosures throughout the country, but particularly in New York and New Jersey. New York judges created new rules for attorney certifying the documents that they provided to the court to be true and exact…

Read MoreDummies Guide to REMIC, Trusts and your Mortgage

First of all let me start by saying that REMIC Laws and Trusts, which are the bases of securitized investment property, is very complicated and convoluted. Experts in securitization and REMIC laws have difficulty sorting through the maze that the banks have created. However, I am going to attempt to reduce it to very basic…

Read MoreOverturned AGARD

A year or so ago, a lot of us consumer/bankruptcy attorneys were ecstatic about Judge Grossman’s decision about MERS and its assignment of mortgages. Judge Grossman could not rule on the case before him if MERS had the authority to assign the mortgage based Res Judicata and Rooker-Feldman doctrine, (Decided cases in state law cannot…

Read MoreHow much will Fannie Mae pay to fire their Servicers?

As many know, Fannie Mae is a complete and utter failure. The creators of Fannie Mae, Freddie Mac and Ginnie Mae, may have had the best intentions, but we all know the saying about having the best intentions. Simply put Fannie Mae was set up to help income based families receive loans to by homes.…

Read MoreUS Attorney General Prett Bharara files complaint against Wells Fargo

Many people have received notices to join in a class action against their mortgage company or servicers. A class action is basically a combination of multiple plaintiffs (in this example homeowners) from multiple states with the same complaint ( in this case fraud, misrepresentation) against the same defendant ( in this example your bank or…

Read MoreThe Dangers Of Entering into a Class Action against your Mortgage Company/Servicer

Many people have received notices to join in a class action against their mortgage company or servicers. A class action is basically a combination of multiple plaintiffs (in this example homeowners) from multiple states with the same complaint ( in this case fraud, misrepresentation) against the same defendant ( in this example your bank or…

Read MoreGoldman agrees to settle mortgage debt class action

(Reuters) – Goldman Sachs Group Inc has agreed to settle a class-action lawsuit with investors who claimed losses on $698 million of securities backed by risky mortgage loans issued by defunct subprime lender New Century Financial Corp. Lawyers for the investors said in a letter filed in U.S. District Court in Manhattan on Tuesday that…

Read MoreNew York AG Schneiderman Proposes Legislation to Protect new Yorkers from Foreclosure Fraud

Attorney General Eric T. Schneiderman today announced the introduction of his bill in the state Legislature that would protect New Yorkers from fraudulent business practices like “robosigning” in the foreclosure process. The Attorney General’s legislation, the Foreclosure Fraud Prevention Act of 2012, will define “residential mortgage foreclosure fraud,” and impose tough new criminal penalties that…

Read MoreForeclosure: Good for Investors, Bad for Foreclosed

An article in www.cnbc.com/id/47818266?__source=RSS*blog*&par=RSS called “Foreclosure Spike Is Positive Sign for Housing” stated that the foreclosure rate going up by 9% from May “month to month” is a good thing. Good for housing and investors; but bad for the ones being foreclosed. I was thinking while reading this that the investors are not the ones…

Read MoreJudgement against Eichenbaum & Stylianou LLC

Eichenbaum and Stylianou LLC is a large debt collector’s firm in New Jersey. Judge Novalyn Winfield found that they violated our client’s bankruptcy protection under 11 U.S.C 362 ( Bankruptcy Case 11-36472; Adversary 11-02539) The bankruptcy law provides that once a client files for Bankruptcy protection all attempts to collect a debt must end. Specifically…

Read More