Criminal Records in Bankruptcy Process

Bankruptcy is an option available to virtually everyone including non-citizens in the U.S. and people with an arrest record or criminal history. With so many people getting arrested for protesting and incurring bail bonds debt, it would be beneficial to know that bail bonds are dischargeable in federal bankruptcy court near me. However, fines and…

Read MoreStudent Borrows Credits Drop with Covid Error

In the government’s initiative to reduce the financial burden on student loans, it has allowed borrowers to delay any loan payments on certain types of loans, mostly federal, until October under the CARES Act. If the HEROES act were to pass in the Senate, after it already passed Congress, then student loan repayments could be…

Read MorePro’s and Con’s To Putting Your Mortgage Into Forbearance

With unemployment on the rise and business shutdown in New Jersey and New York , more people are considering putting their mortgage payments into forbearance. A mortgage payment in forbearance means delaying the payments without penalty fees after giving notice to the creditor. When the unemployment checks run out in July and late August, many…

Read MoreDevos Sued For Garnishing Wages Against Presidents Orders

During her time as the Secretary of Education, Betsey Devos has plummeted the department into the ground with another lawsuit for garnishing wages from student borrowers during the coronavirus. Devos announced in March that she would take administrative action to prevent this practice, and the Trump CARES act protects borrowers from such measures. Politico reported…

Read MoreWhat does the Coronavirus mean for your student loans?

President Trump signed a bill providing financial relief for Americans struggling in the wake of the coronavirus shutting down all non-essential businesses. Part of that bill granted a six-month suspension period on federal student loan payments until September 30th. However, not all federal loans are included in the bill and loan providers are not adapting…

Read MoreBiden Legislation Stripped Borrowers of Their Bankruptcy Protections

Before Biden and Warren were at odds for the Democratic Presidential nomination, they faced off against bankruptcy protection laws, with Biden successfully stripping them away right before the 2008 housing crisis. In 2005, Biden pushed through a bill called the Bankruptcy Abuse Prevention and Consumer Protection Act (BAPCPA) intended to prevent people from abusing a…

Read MorePG&E Struggles to Remain Out of Bankruptcy Amid Victim Claims

PG&E (Pacific Gas and Energy) is struggling to come up with a plan to avoid filing for bankruptcy in the midst of constant blackouts and wildfires that have ravaged California. As California’s largest utility, the state is threatening to take over due to a lack of an agreement between the company, fire victims and its…

Read MoreIs the Coal Industry Slipping into Obsoletion?

On Friday, Oct 11, CNN Business reported that Murray Energy owned by Robert Murray, the “king of coal”, is slipping into “financial collapse”, thus marking another coal business plummeting into bankruptcy. For coal miners and those in the coal industry, this means that the industry will likely become obsolete within the next few years among…

Read MoreJudge Drain Rules in Decision Best for Opioid Survivors in Purdue Pharmacy Bankruptcy

Last Friday, October 11, White Plains Bankruptcy Judge Robert D. Drain paused legal action between 25 states suing Purdue Pharmacy. The New York Times reported that Judge Drain made this decision to prevent mounting litigation costs that would take away from the settlement to opioid survivors and other parties in the Chapter 11 bankruptcy settlement. …

Read MoreDeVos Could Charged with Contempt for Violating Court Order

Betsy DeVos could be facing jail time if not sanctions for violating an order from a federal judge who prohibited any further collection of student loan debt from Corinthian College students. U.S. Magistrate Sallie Kim ordered the Department of Education to cease collection from these student borrowers since they fell under the protection of the…

Read MoreWhere Student Loan Debt is Heading By 2021

Student loan debt is the largest financial crisis facing young Americans today, and has reached the highest its ever been in all of history. It’s causes can be traced back to several sources, the foremost being 1) increasing tuition rates with little to no increase in wages, and 2) predatory practices by private and federal…

Read MoreStudent loan debt becomes personal in Congress

Congressmen are just like us; they have student loan debt too! For the lawmakers that could provide student loan debt relief, many of them still have enormous amounts of debt themselves that they are required to make payments on. The media buzzed over Congresswoman Ocasio-Cortez making a student loan payment during a committee meeting over…

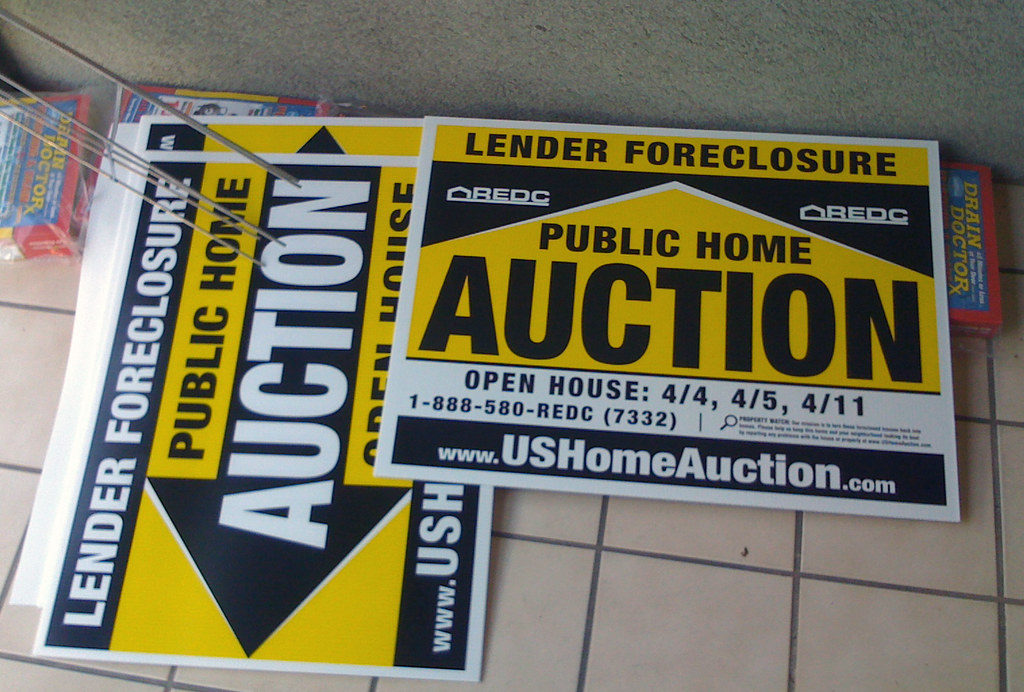

Read MoreDitech bankruptcy could leave homeowners in foreclosure

The New York Attorney General’s office is trying to block the approval of a bankruptcy plan for the mortgage company Ditech. The New York AG office released a statement that objected to the sale of the company as a part of its bankruptcy deal that would release Ditech from any obligation to pay the $1…

Read MoreMore than meets the eye: New Yorker satire closer to truth

“Pay Off Your Student Debt in Three Easy Lifetimes” advertises a recent satirical piece by Colin Nissan in The New Yorker’s recent August issue that follows a Q&A interview between an outraged interviewer and a calm expert on this new software program for student loan debt. The conversation winds around this bizarre solution to debt…

Read MoreDepartment of Education being sued by Teachers

First states and now teachers are suing the Department of Education for the faulty program intended to help student loan borrowers: the public service loan forgiveness program. Previously last summer, four states including California, Pennsylvania, Washington, and Illinois sued the government agency Navient for its mismanagement of private and federal student loan debt, especially for…

Read More